This article is sponsored by Thetanuts Finance.

From its humble beginnings, decentralized finance, or DeFi, has evolved into a flourishing ecosystem of exchanges, lending platforms, and all manner of financial instruments that closely mimic what traditional finance can offer and more. Although DeFi has created a permissionless and more inclusive environment for users to participate in various financial instruments, more complex products like options are still favored by just a small segment of users. While institutions and veteran traders would be more familiar with options, most crypto users would find them confusing and difficult to understand.

Be that as it may, that hasn’t stopped various DeFi projects from trying their best to simplify the experience of trading or underwriting decentralized options for newcomers. From liquidity pools to DeFi Options Vaults (DOVs), the design of decentralized options has undergone multiple iterations, yet most crypto natives remain unconvinced. In a space where most users are always looking for the simplest ways to earn the highest yield, options tend to be too complex, especially for the casual crypto crowd.

With that in mind, Thetanuts Finance, a multi-chain platform offering structured options products, has announced the launch of its v3 upgrade. Acknowledging the shortcomings of DOVs, Thetanuts Finance v3 will see the platform transitioning into a fully-fledged marketplace for decentralized on-chain options, with its own lending market and use of Uniswap v3 pools. Join us as we look at the current disadvantages of DOVs, how Thetanuts Finance v3 does it differently, and a potential airdrop from their upcoming v3 Incentivized Alpha. If you’re unfamiliar with crypto options, you can take a look at our previous guide on crypto options to learn about their basic components, how they are priced, and how they are used for speculation and hedging.

The Current State of Options in DeFi

Popularized by protocols such as Ribbon Finance and Thetanuts Finance, DeFi Options Vaults have become one of the go-to methods for newcomers to leverage sophisticated options strategies bundled together into a single structured product. With simple interfaces and a smooth user experience, DOVs make it easy for users to deposit their funds in one click and earn yields from selling options, while the vaults do the heavy lifting from behind the scenes.

Essentially, DOVs work in a similar fashion to most yield aggregators but utilize specific option strategies to generate yield. The vast majority of DOVs sell out-of-the-money (OTM) cash-settled options, which have yet to exceed or drop below the strike price, to generate yield in the form of options premiums. Accredited market makers such as GSR, QCP Capital, or Wintermute will then bid on these options through a blind auction conducted every epoch, usually on a weekly or bi-weekly basis. These vaults are generally managed by the protocol itself, with preset parameters that algorithmically determine the strike price and expiry date for the options before they are sold.

If the options expire out-of-the-money, the options premiums earned will be reinvested back into the vault after every epoch, compounding yields for users over time. On the other hand, if the options are exercised, the vaults will be obligated to sell the vault’s underlying asset, resulting in users losing part of their deposits. While this design has allowed DOVs to thrive during a more positive market environment in 2021, their performance has been marred by the recent downturn in the crypto markets, highlighting the product’s several flaws.

Limited Opportunities

Most DOVs today act as the issuers and are mainly focused on selling options to external parties. While users are free to purchase individual options through many other decentralized platforms, there is a lack of vault products catering to users who wish to utilize structured products to go long on options instead.

Furthermore, once users deposit their funds, there is a limited withdrawal period after every epoch before the options are sold. Once the auctions have been completed, user deposits are locked in and cannot be withdrawn until the end of the epoch. In other words, there is a period of illiquidity during epochs where users with sparse capital are unable to withdraw funds, even if they need it to repay a loan or utilize it elsewhere.

Not An Entirely Passive Strategy

As mentioned previously, DOVs are similar to yield aggregator vaults, where users can simply deposit their funds and let the vaults generate returns. This mechanism encourages a ‘set-and-forget’ strategy, especially for yield aggregator vaults that utilize safer strategies such as liquidity provision, where their initial funds are usually protected. On the contrary, while their names are similar, participating in a DOV is largely the same as speculating on the price of an asset, as a user can lose money if options are exercised, exposing users to risk from the asset’s price movements.

Furthermore, in a constantly shifting market, DOVs configured to run certain strategies may become less effective in different market conditions. The burden lies on the depositors to take on a more active role in managing their deposits by adapting to changing market environments and rotating their deposits through different vaults as needed. While some users may be more willing to commit to an active approach, more passive users may not be as keen or risk taking losses.

The Nature of Professional Market Makers

While most users participating in DOVs are largely crypto newcomers or users with little to no experience with options, the same cannot be said for their counterparties. The market makers that purchase the vault’s options are generally more sophisticated and experienced. Be that as it may, these market makers still play an integral part in helping DOVs collect option premiums, but they are slowly turning away from them due to capital inefficiency and the small volume of options available for them to bid.

In this challenging environment, many protocols have recognized that the current design of DOVs simply will not do, with some ceasing operations or pivoting to other derivatives entirely. Not to be left behind, Thetanuts has also made the decision to convert its existing platform into Thetanuts Finance v3, an all-in-one decentralized options marketplace where users can buy, sell, borrow, and provide liquidity for options of various long-tail assets.

Thetanuts Finance v3

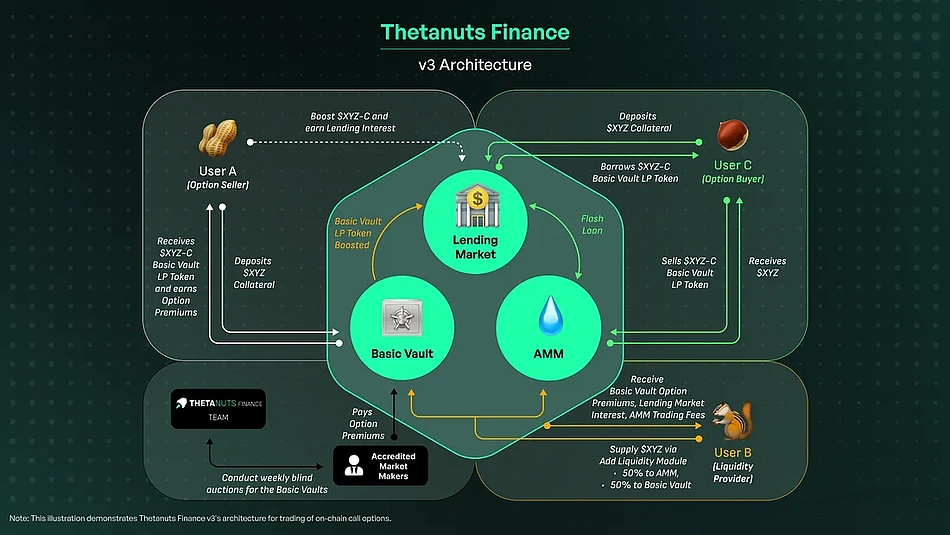

Source: Thetanuts Finance

Source: Thetanuts Finance

With the release of Thetanuts Finance v3, the platform has evolved from purely a DOV platform into an all-in-one DeFi suite for options. Thetanuts Finance v3 will consist of three key components - their existing Basic Vaults, a lending market, and Uniswap v3 pools for trading options – which will all be accessible from their redesigned trading interface.

Basic Vaults

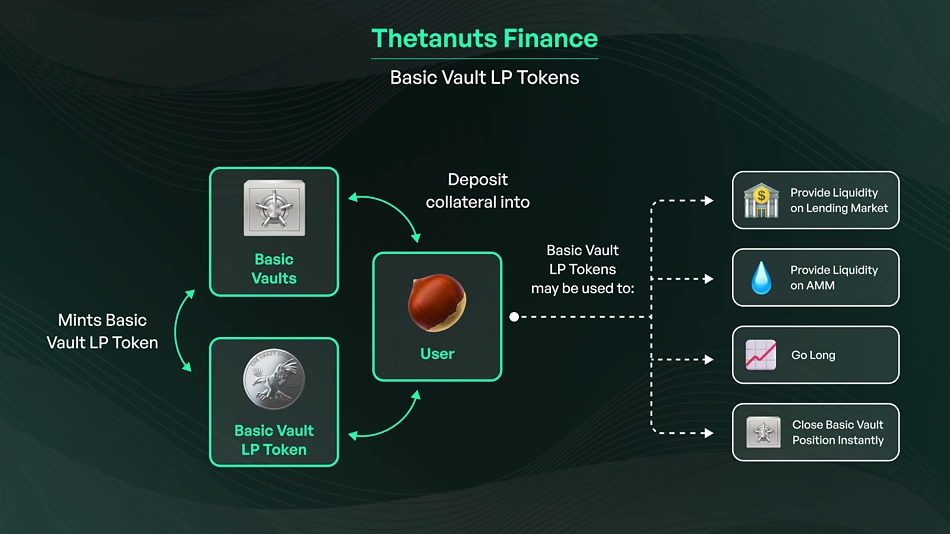

As one of Thetanuts’ core products, Basic Vaults will continue to play an integral part in Thetanuts Finance v3, where users can provide liquidity to sell options to earn yields from option premiums. They function pretty much like any other DOV that we’ve discussed above but have additional utility within the Thetanuts Finance ecosystem. Depositors will receive a Basic Vault LP token, representing their share of the underlying funds for a particular vault. These LP tokens can then be used to:

-

Provide Liquidity on Lending Market: Basic Vault LP tokens can be deposited into the Lending Market to generate additional lending interest.

-

Provide Liquidity on AMM: Basic Vault LP tokens can be deposited into the AMM to generate additional AMM trading fees.

-

Go Long: Users interested in a long volatility position may borrow the Basic Vault LP Tokens from the Lending Market and sell them on the AMM, representing a long call or long put position.

-

Close Basic Vault Position Instantly: A Basic Vault LP Token holder may sell the position on the AMM, representing an instant close of the short call or short put position without having to wait for the end of the Basic Vault epoch.

Source: Thetanuts Finance

Source: Thetanuts Finance

Besides that, users will no longer have to endure lengthy withdrawal periods. They can instantly sell their vault LP tokens anytime on the AMM to close off their vault positions, providing greater flexibility for short-term traders to go long on options.

Lending/Borrowing Market & AMM

Source: Thetanuts Finance

Source: Thetanuts Finance

Leveraging Aave and Uniswap’s battle-tested smart contracts, Thetanuts Finance v3 will also include the creation of a lending market and AMM specifically for Basic Vault LP tokens. These markets will function in a similar way to existing DeFi protocols, where lenders supply Basic Vault LP tokens to earn interest yields from borrowers on the lending market, and users will be able to provide liquidity using Vault LP tokens paired with the underlying asset on the AMM

In combination with the aforementioned Basic Vaults, users are no longer relegated to just selling options - they can easily switch their exposure between longing or shorting options by utilizing the different components of Thetanuts Finance v3.

Users wishing to go short on options can simply do so via the Thetanuts Finance v3 Trading Interface, where collateral is deposited into the Basic Vaults to generate Basic Vault LP Tokens. The value of the short option position increases as the user receives option premiums for selling an option, with the position only decreasing in value if the price of the underlying asset surpasses the strike price of the option.

On the other hand, users wishing to go long on options can also simply do so via the Thetanuts Finance v3 Trading Interface – where collateral is deposited into the lending market. A flash loan occurs, allowing users to borrow up to 20x the collateral, with the borrowed collateral then sold in the AMM to achieve a long option position.

Add Liquidity Module

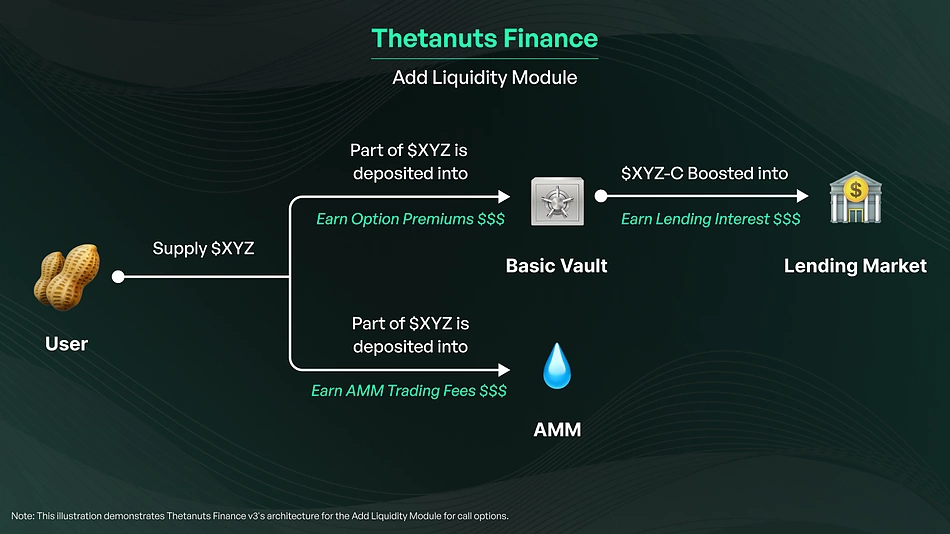

Source: Thetanuts Finance

Source: Thetanuts Finance

With the three components mentioned above underpinning the architecture of Thetanuts Finance v3, users can now easily go long or short on on-chain options. However, the integration of the Add Liquidity Module also serves as a crucial advancement in optimizing liquidity provision, allowing users to provide liquidity to all three components – gaining access to up to five sources of yield.

If a user has a bearish outlook, they can deposit the Basic Vault’s underlying assets into the Add Liquidity Module.

-

Part of the assets (e.g. $XYZ) will be deposited into the Basic Vault to generate Short Call Basic Vault LP Tokens (e.g. $XYZ-C), which is then Boosted in the Lending Market to earn interest.

-

A portion of the remainder will be deposited into the $XYZ/$XYZ-C liquidity pool on Uniswap v3 to earn trading fees.

If a user has a bullish outlook, they can deposit USDC into the Add Liquidity Module.

-

Part of the USDC will be deposited into the Basic Vault to generate Short Put Basic Vault LP Tokens (e.g. $XYZ-P), which is similarly Boosted in the Lending Market.

-

A portion of the remaining USDC is then deposited into the $XYZ-P/USDC liquidity pool on Uniswap v3.

In both cases, the user would have access to up to five yields on Thetanuts Finance v3:

-

Option Premiums from Basic Vaults

-

Lending Interest from Lending Market

-

Trading Fees from AMM

-

Potential $NUTS Token Incentives (Future)

-

Potential Additional Token Incentives (Future)

Thetanuts Finance v3 Incentivized Alpha and Potential NUTS Airdrop

In December 2023, Thetanuts Finance launched Phase 1 of its v3 Incentivized Alpha for the platform’s v3 upgrade. The launch of the v3 Incentivized Alpha officially marks the protocol’s first steps of transitioning into a fully decentralized product suite for on-chain options, with a revamped trading interface, landing page, and updated documentation.

The launch of the v3 Incentivized Alpha aims to bring together traders and liquidity providers from across the crypto space to experiment with the Thetanuts Finance v3 architecture in an effort to bootstrap initial TVL and trading volume to support a growing number of users. Additionally, the v3 Incentivized Alpha will allow users to provide insightful feedback and request adjustments and improvements to the Thetanuts Finance v3 protocol before their official mainnet launch.

The v3 Incentivized Alpha is split into 2 phases. Phase 1 will primarily cater to traders to familiarize themselves with the latest trading features of Thetanuts Finance v3, while Phase 2 will introduce liquidity provision and how users can generate yield from multiple sources by providing liquidity. Furthermore, the v3 Incentivized Alpha will run on Arbitrum, where users will get the full v3 experience and enjoy ARB token incentives from Thetanuts Finance, being a recipient of Arbitrum STIP Round 1.

Be it as it may, how can users benefit from participating in this v3 Incentivized Alpha? Well, from the program's name, it’s very likely that a potential airdrop of Thetanuts’ long-awaited governance token will be distributed to participants. Based on their V3 upgrade announcement, the Thetanuts Finance team also mentioned the launch of their NUTS governance token, which will play a crucial part in decentralizing protocol governance as well as rewarding the project’s core community members.

As Phase 1 of the v3 Incentivized Alpha concludes, the team has seen strong interest and engagement from the community, receiving over 70,000 applications to participate in the program. Whitelisted users who made the cut have participated heavily during Phase 1, racking up over $10.4M in TVL and over $5.7M in trading volume. With Phase 2 launching just recently, the focus will now shift to Liquidity Providers, where users will be able to explore the new liquidity features and stand a chance to earn NUTs tokens.

In conjunction with the launch of Phase 2, Thetanuts has also teamed up with Coinlist to bring their v3 Incentivized Alpha to participants from over 170 countries. Additionally, the team has confirmed that users’ TVL and trading volume will heavily affect their eligibility to earn NUTS rewards, although no specific airdrop criteria have been confirmed.

Conclusion

With so many protocols out there hosting their own incentive programs with the expectation of a future token airdrop, it can be hard for users to narrow down the best projects to experiment with, especially with limited capital. The launch of the Thetanuts Finance v3 Incentivized Alpha provides not only an opportune moment for users to dive deeper into the world of options but also a concrete chance to earn future token rewards. By testing the protocol’s latest architecture and providing valuable feedback, users can potentially make a difference in creating the next wave of decentralized options and further push the boundaries of DeFi.

If you are interested in participating, just head over to https://www.thetanuts.finance. Once you’re in, you may want to experiment with the platform’s features by selling or buying options or providing liquidity to the protocol. Besides that, you may also want to focus on utilizing those options by providing liquidity on their AMM or lending platform to maximize your potential airdrop further. But as always, you should exercise caution and only deposit and trade with the amount of funds you are willing to risk. With that being said, good luck and happy hunting!

CoinGecko's editorial team comprises writers, editors, research analysts and cryptocurrency industry experts. We produce and update our articles regularly to provide the most complete, accurate and helpful information on all things cryptocurrencies. Follow the author on Twitter @coingecko

Or check it out in the app stores

Or check it out in the app stores