What Are the Top Projects to Watch on Solana in 2024?

- DEXs: Jupiter, Orca and Drift

- Lending protocols: Solend, Marginfi and Kamino

- Staking: Marinade Finance and Jito

- NFTs: Mad Lads and Tensorians

- DePIN: Helium and Render Network

Key Takeaways

-

Solana is a Layer 1 that offers high throughput and low fees for transactions.

-

With over 125 protocols in its ecosystem, the Solana blockchain executes an average of 100 million transactions daily.

-

The Solana ecosystem includes DEXs like Jupiter and Orca, lending protocols like Solend, liquid staking protocols like Marinade Finance and Jito, and NFT projects like Mad Lads. There are also DePIN projects like Helium and Render which are looking to take advantage of Solana's higher throughput.

The Solana network and its ecosystem is seeing a new boom. Thanks to the project’s recovery (price-wise), a significant reduction in network outages (none since February 2023), and an array of positive events around the project in the last quarter of 2023, Solana has become a strong point of attention for cryptocurrency investors and developers. Existing projects on the ecosystem are seeing an increased adoption while new projects are exploring the benefits of deploying on the networks.

Solana boasts cheap transactions and faster processing speed relative to many other smart contract blockchains. According to the network explorer, the Solana network processes at least 100 million transactions daily from an average of 500,000 active wallets and tons of decentralized applications and smart contract tokens.

The network has also seen a boom in memecoins, which has contributed significantly to the increased network activities. Other catalysts for this growth in activity include developments from popular projects in the ecosystem like Jupiter exchange, Jito, and Tensorian.

Now, let’s look at some of the biggest projects on Solana and their key features.

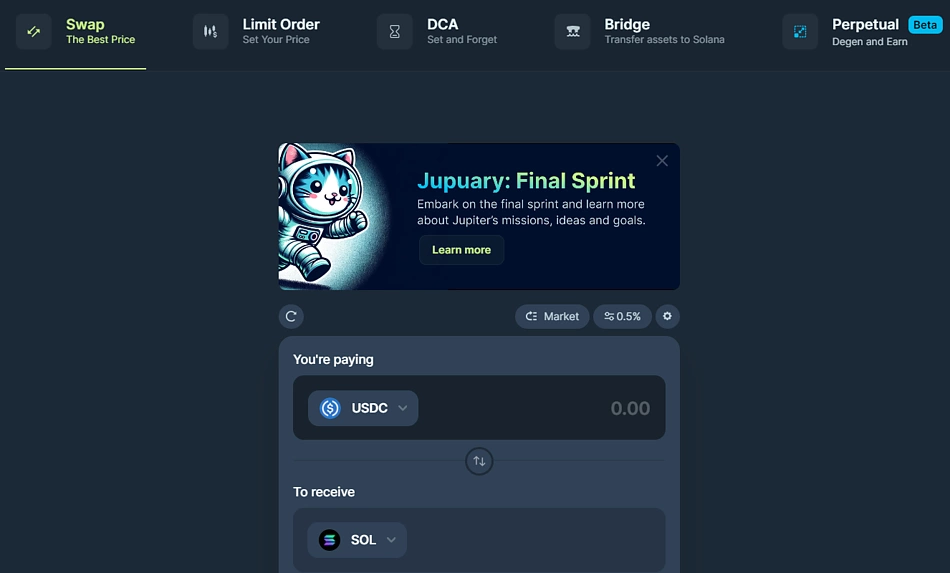

Jupiter: Streamlining Token Swaps on Solana

Jupiter claims to be building a decentralized replacement for centralized exchanges on the Solana network. It is a limit-order decentralized swap on the network with an array of services for traders on the network.

Jupiter Swap features a DEX aggregator, which presents users with the best price offer from supported DEXs on the network. In addition to the direct asset swap feature, users can also place limit orders using Jupiter Swap, which helps users set a desired purchase price as seen on centralized exchanges. Jupiter Swap also features an asset bridge for moving assets between the Solana network and other supported blockchain networks. Jupiter also has a DCA feature that helps users make purchases or sales in splits. Finally, Jupiter also features a decentralized perpetuals trading platform with up to 100x leverage.

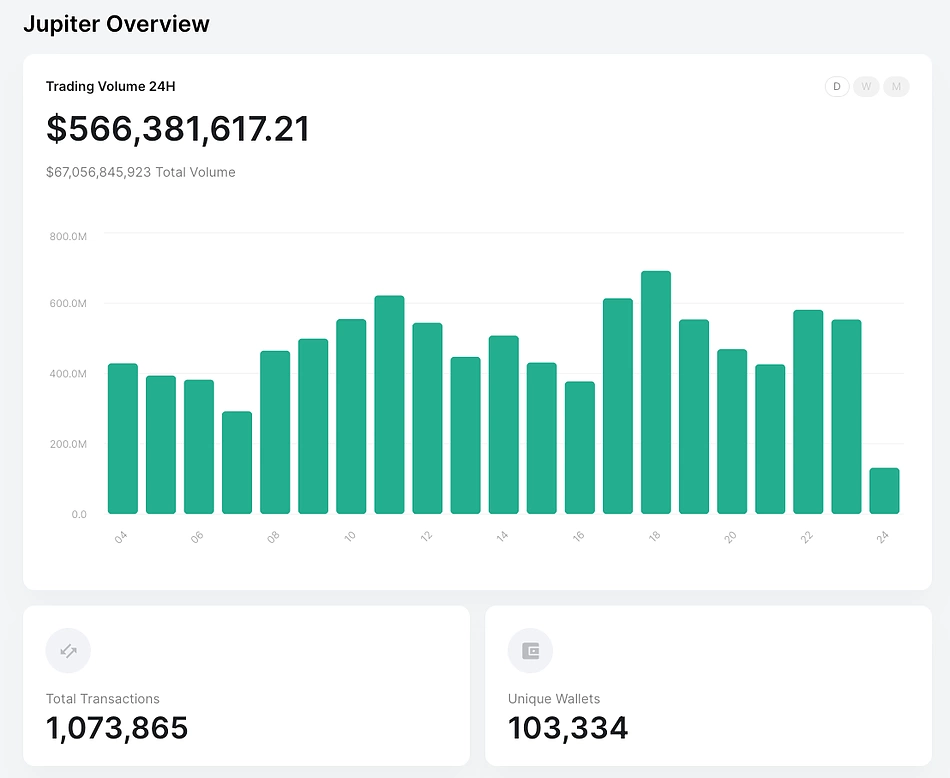

Jupiter is one of the biggest decentralized applications on the Solana network. According to Jupiter, an average of $400 million worth of crypto assets traded on the platform daily by at least 90,000 unique wallets.

Orca: Concentrated Liquidity AMM on the Solana Network

Orca claims to be the most efficient liquidity decentralized exchange on the Solana network that offers the best user experience. Through its concentrated liquidity feature, Whirlpools, Orca promises higher returns for liquidity providers while offering traders lower slippage across supported trading pools.

Orca’s Concentrated Liquidity AMM allows liquidity providers to state a price range at which their tokens will be available for use by the market maker – a similar feature to Uniswap V3’s concentrated liquidity. Orca also incentivizes liquidity providers using a share of the trading fee generated on the platform. According to DefiLlama, the total value locked on the Orca DEX is about $185 Million.

Orca is governed by its community via the Orca DAO which operates using the ORCA token and the DAO council. ORCA is also dedicated to philanthropy programs focused on the environment and developments around the project. ORCA is listed on Kucoin, Gate Exchanges, and Coinbase. See active trading pairs for the ORCA token.

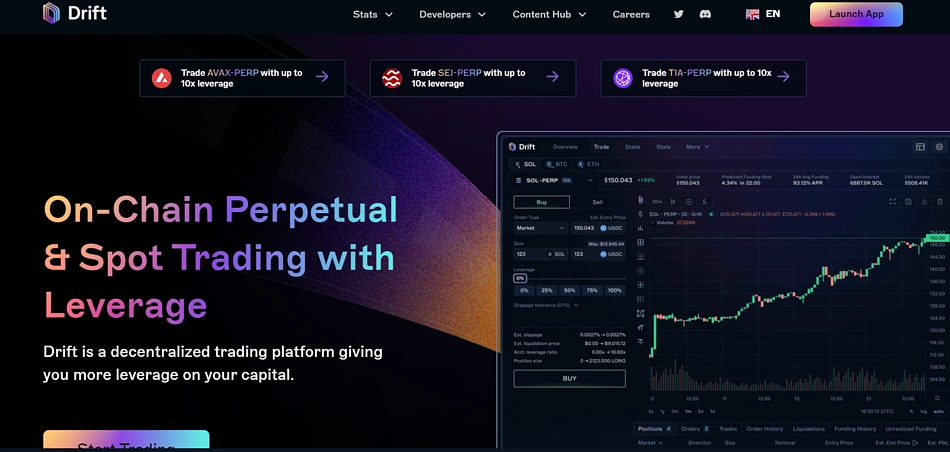

Drift: Trade Perpetuals With up to 20X Leverage

Drift is a decentralized perpetuals trading platform on the Solana blockchain. Perpetual traders on Drift can open long or short positions with up to 20x leverage. Drift claims to deliver a CEX-like experience to perpetuals traders on its platform. Additional utilities on the platform include up to 5X leverage direct asset swap, leveraged spot trading, and a decentralized lending service. The Drift lending protocol is a full-suite money market where users can borrow crypto assets against their collateral.

Drift also claims to offer users several passive income opportunities through staking and market maker rewards and rewards for liquidity providers. Drift’s staking program is known as Insurance Fund Staking. Users commit their assets to the Drift vault and earn commissions from exchange fees. According to statistics presented by the project, almost $120 million worth of crypto assets are locked on Drift’s smart contracts. The platform has over 85,000 active users and has executed over $4 billion worth of trades.

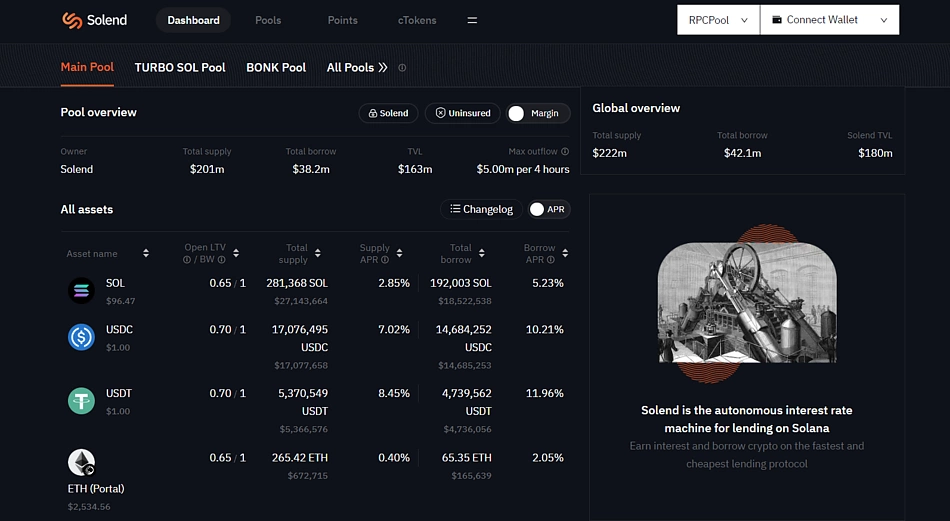

Solend: Lend and Borrow Crypto Assets on the Solana Network

Solend is a money market on the Solana blockchain. According to the project, it aims to be the easiest to use and the most efficient solution on the network. Users on the network can borrow and lend crypto assets on Solend. Borrowers present collateral and agree to the loan contract which includes paying a stated percentage interest to the lenders. Solend also features a liquidation function that salvages bad loans and keeps the protocol running. According to DefiLlama, over $165 million worth of crypto assets are locked on Solend smart contracts at the time of writing.

Solend (SLND) is the native token of the project. It is used to incentivize liquidity providers and fund development proposals by the community. Solend is managed by the community via the Solend DAO using the Solend token. SLND is listed on Gate exchange, CoinEX, and decentralized exchanges on the Solana network. See active trading pairs for SLND.

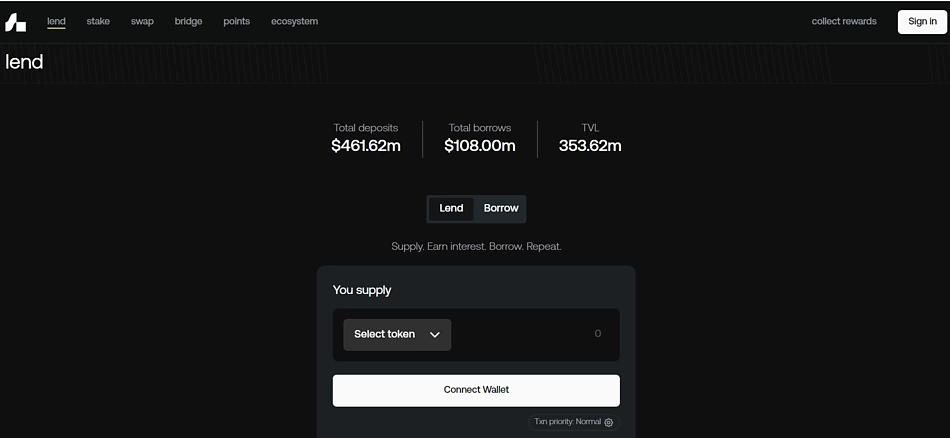

Marginfi: Solana-Based Lending Protocol With a Focus on Risk Management

Marginfi lets users borrow crypto assets against collateral. It is an overcollateralized money market on the Solana blockchain with over $345 million worth of cryptocurrencies locked in its smart contract. Marginfi works like every other lending protocol, however, it claims to have advanced risk management technologies that keep users informed of the status of their loan and also keep the protocol running.

It is equipped with an automatic liquidation protocol that rids the system of bad loans and keeps the whole protocol healthy. Marginfi also runs an ecosystem of utility applications that include the Marginfi xNFT, and the Marginfi liquidation prototype. These applications are powered by the Marginfi SDK. Users can also bridge assets between Solana and other supported blockchain networks using Marginfi’s bridge powered by Mayan, and can enjoy swaps powered by Jupiter.

Marginfi offers liquid staking services as well. According to the project, staking under its validator offers certain benefits including increased rewards and zero staking fees in addition to improved staking yield.

The protocol has also introduced mrgn points, which reflect the level of a user’s engagement with Marginfi. Users can earn points by interacting with the protocol, and this can potentially lead to an airdrop opportunity.

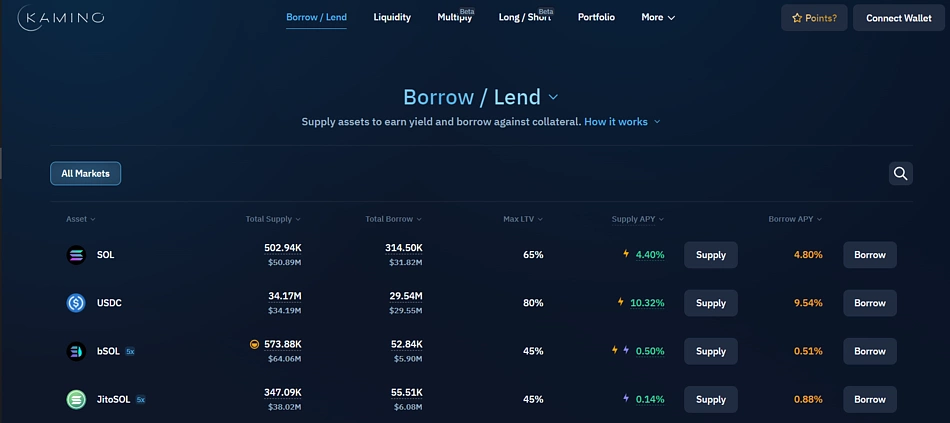

Kamino: Liquidity Layer and Lending Protocol on Solana

Kamino is an automated liquidity solution on Solana. It provides users with a platform to deploy their tokens into yield-bearing programs through liquidity pools. Users provide liquidity across supported pairs and receive Ktokens – a representation of their tokens held in the pool. Pooled tokens are deployed on DEXs and users’ yields are reflected in the Ktoken.

Ktokens can be used as collateral in Kamino’s lending protocol. The lending protocol enables users to borrow crypto assets against their collateral. The lending protocol works similarly to other decentralized lending protocols but uses the CLMM (Concentrated Liquidity Market Maker) to control the availability of assets in the lending vault. According to data from DefiLlama, the total value locked on Kamino is over $242 million at the time of writing.

Marinade Finance: Staking Optimization Protocol on the Solana Blockchain

Marinade Finance claims to maximize returns for stakers on the Solana network. It commoditizes staked assets, making them more flexible and utilizing this flexibility to pursue higher yields for stakers. According to the project, it screens over 100 validators on the Solana network and routes staked assets across the best-yielding validator.

It pursues real yield for Solana native stickers through liquid staking. Liquid-staked Solana on Marinade Finance is known as marinated Solana (mSol). In the future, when restaking protocol Picasso launches, mSol holders can commit their LST to Picasso to gain more yield.

Marinade Finance allows users to unstake instantly and claim their rewards without needing to wait. Marinade Finance’s staking protocol is integrated into several other projects like Coinbase, Orca, and native wallets. Users can access these services from the supported platforms and protocols. According to DefiLlama, Over $1 billion worth of crypto assets are locked on Marinade Finance’s smart contracts.

Marinade (MNDE) is the native token of the platform. It is used as a utility, incentive, and governance token of the platform. MNDE holders make up the Marinade DAO and are qualified to vote on development and marketing proposals. MNDE can be traded on Solana-based DEXs and centralized exchanges like Coinbase and Kucoin. See active trading pairs for MNDE.

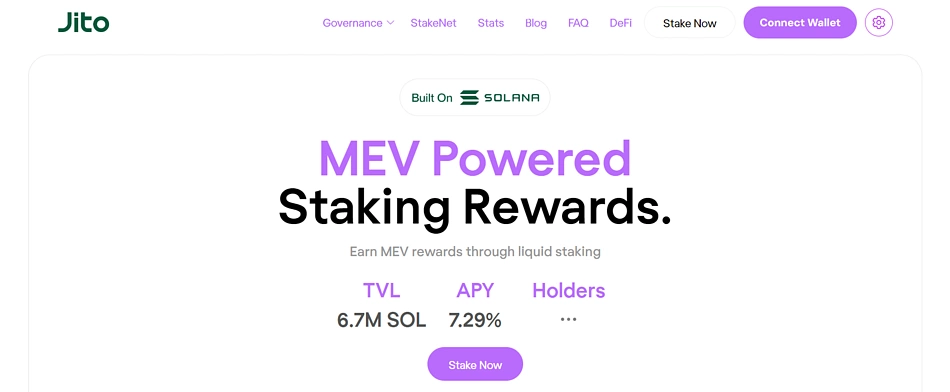

Jito: Enhancing Staking Yield via MEV

Jito claims to improve yield earned by stakers via MEV rewards, while minimizing negative externalities. MEV (Maximum Extractable Value) is the highest extra charge a validator can apply to transactions or a user can extract from a DeFi protocol. MEV is a measure of profitability. Jito claims to extract more value from DeFi protocols on the Solana blockchain and distribute these rewards amongst stakers on its platform.

Jito also offers liquid-staking services, liquid-staked Solana on Jito protocol is known as Jito Sol (jitoSOL) and, like Marinade’s mSol, can be committed to restaking protocols when available. Jito claims to utilize the staked assets in achieving a secure network for the Solana blockchain and real yield for the stakers. jitoSol can also be used across supported liquidity and DeFi protocols. According to available data, about 6.7 million SOL are staked on Jito by over 135,000 holders

Jito protocol is controlled by the Jito DAO. Holders of the Jito token (JTO) vote on improvement proposals for the protocol. Jito is also used as an incentive for liquidity providers on Jito and jitoSOL pairs. Jito can be traded on Binance, Coinbase, and decentralized exchanges on the Solana network. See active trading pairs for Jito.

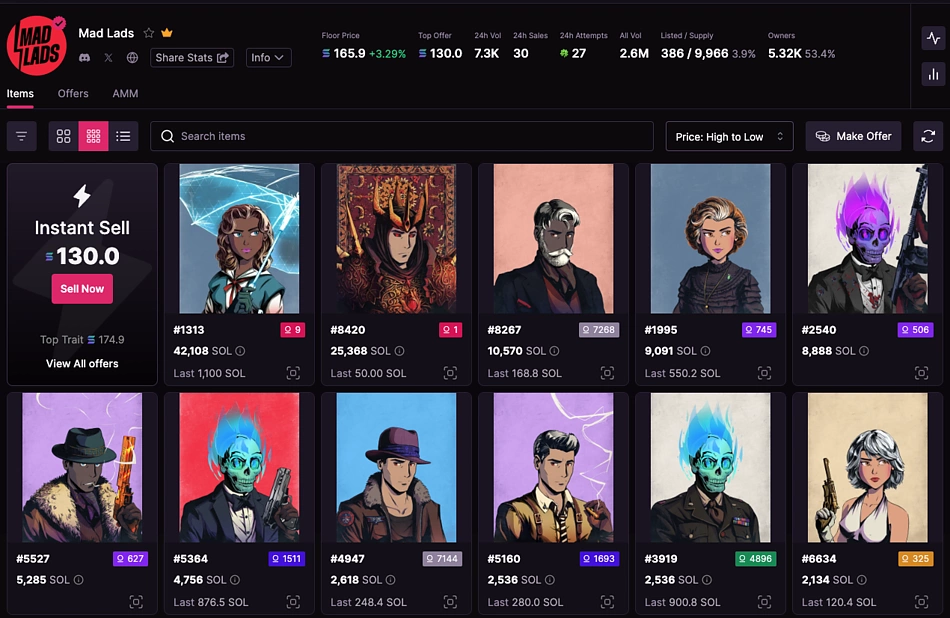

Mad Lads: xNFT Collection on Solana

The Mad Lads NFT collection was created by Coral, a Solana framework development company. It is a collection of 10,000 unique artwork featuring humanoid characters with specific attributes and rarity. About 9,966 Mad Lads have been minted and are held by over 4,200 NFT collectors on the network. Each piece of art in the collection has a unique identity; the rarity attributes apply to the character’s gender, clothing, facial expression, type, and hair, amongst other attributes.

Mad Lads NFTs are xNFTs, which means they are NFTs with an embedded code script that can be executed by an application that supports them, like the Backpack wallet, which is also developed by Coral. For example, the programmable nature of xNFTs means that users don’t need to access third-party platforms to stake Mad Lads NFTs; instead the feature is integrated into the asset, and can be staked directly from the Backpack wallet.

In December 2023, Mad Lads NFTs recorded a new ATH in floor price at over 229 SOL. Based on the value of SOL at that time, this is well over $20,000. Mad Lads NFTs can be traded on Solana NFT marketplaces.

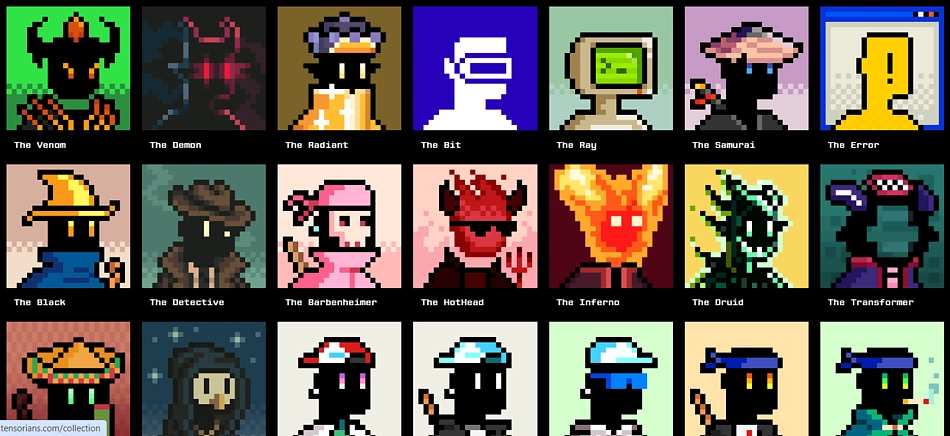

Tensorians: NFT Collection for Fans of Tensor

Tensorians commemorates NFT traders on Tensor – an NFT marketplace on the Solana blockchain. Tensor claims to add flare to NFT trading via features like a collection’s trading history and real-time trading activity. According to the project, Tensorians are the most dedicated fans of the project. 10,000 NFT arts make up the Tensorians collection. Holders are eligible for certain perks including exclusive drops. According to data from CoinGecko, the floor price of the Tensorians collection is 96 Sol at the time of writing. Tensorians can be traded on Solana NFT marketplaces including Tensor.

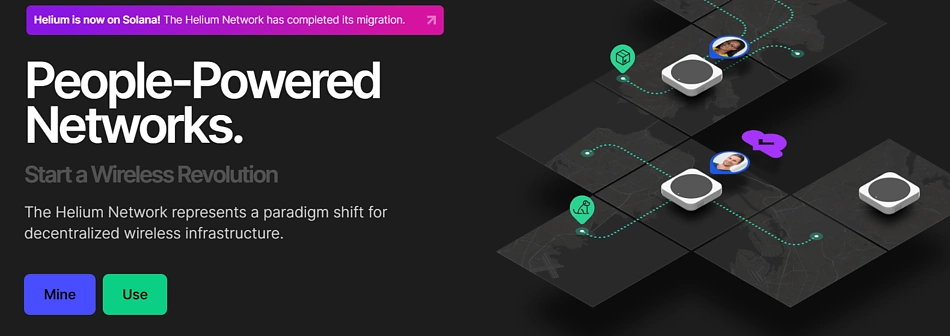

Helium: Decentralized Connectivity Service Provider

Helium migrated to the Solana blockchain in April 2023. The decentralized physical infrastrucutre (DePIN) project hopes to change the way people use and commoditize Internet services. Helium allows people to run their own hotspot services; it plans to use the Solana blockchain as a remittance and administrational platform for its internet services. Helium manages the security and record-keeping aspect of the decentralized internet facility while hotspot owners focus on sharing their internet resources and receiving rewards, relative to the connectivity services provided.

Helium operates a multi-token system with each token in the ecosystem serving a purpose in the provision of network resources and rewarding providers. Hotspot owners are incentivized with Helium tokens (HNT), and HNT is burnt by users to obtain connectivity services. Meanwhile the MOBILE token powers the recently launched Helium 5G project, where 5G Hotspot bundle owners provide network coverage and earn the MOBILE token. Both tokens are tradable on decentralized exchanges in the Solana ecosystem. See active trading pairs for HNT and MOBILE.

Render Network: GPU Rendering Protocol for Creators

In December 2023, Render Network announced plans to expand its services to the Solana blockchain. Render Network is used to rent out excess GPU power to creators in need of additional GPU to render graphics. Render Network hopes to enable creators to deliver high-resolution graphics. Artists or other content creators can rent GPUs from miners who have excess and idle GPUs. Using the Proof of Render algorithm (a variant of the Proof of Work algorithm), artists can confirm that payment for their art has been made before they release/upload their art or content.

Render Network is powered by the Render token (RNDR). RNDR is used as the remittance token on the network, service providers earn RNDR rewards. Artists on the Render Network can trade RNDR in exchange for GPU power from node operators. Render token also powers the Render DAO and is used to fund development proposals. RNDR is listed on Binance, Kucoin, Coinbase, and other centralized exchanges. See active trading pairs for Render token.

Final Thoughts

Solana is a force in the smart contract blockchain space and is growing exponentially. Recent growth in usage data is a testimony of investors’ recognition of the utilities and advantages the network holds. The Solana token has climbed to the top 5 ranks following an impressive price discovery. Projects in its ecosystem will hope to grow in light of the project’s popularity while deploying their solutions on the network, which it claims to offer a competitive throughput.

In this article, we explored a few projects in the Solana ecosystem. These projects hope to strengthen the appeal of the Solana network by delivering quality products to users. Note that this list is not exhaustive of projects on the Solana network, nor is it a hierarchical presentation. This article only discusses projects in the Solana ecosystem and is not financial advice or endorsement for users to invest in these projects. Always do your own research before connecting your wallet to any protocol.

Joel is deeply interested in the technologies behind cryptocurrencies and blockchain networks. In his over 7 years of involvement in the space, he helps startups build a stronger internet presence through written content. Follow the author on Twitter @agboifesinachi

Or check it out in the app stores

Or check it out in the app stores