What Is Celestia?

Celestia is a modular data availability (DA) layer. It is a plug-and-play module allowing anybody to spin up their own blockchain without needing a validator set. Providing cost-effective data availability allows for greater scalability and customization while maintaining shared security. Celestia is a building block that makes customized execution environments economically feasible.

Basically, Celestia allows developers to build cooler, more application-specific rollups.

Key Takeaways

-

Celestia provides a data availability layer service for rollups.

-

Rollups leveraging Celestia’s data availability layer but using Ethereum for settlement and dispute resolution are called Celestiums.

-

Celestia is a building block for creating bespoke execution environments.

Celestia is tech-heavy, and grasping its value proposition entails a relatively robust grasp of blockchains and their infrastructure, as well as the monolithic versus modular debate. Modularity is the next meta-leap for the crypto space. It involves dividing a blockchain into distinct components. Segmenting a blockchain allows for the optimization of each function, and Celestia specializes in data availability and consensus.

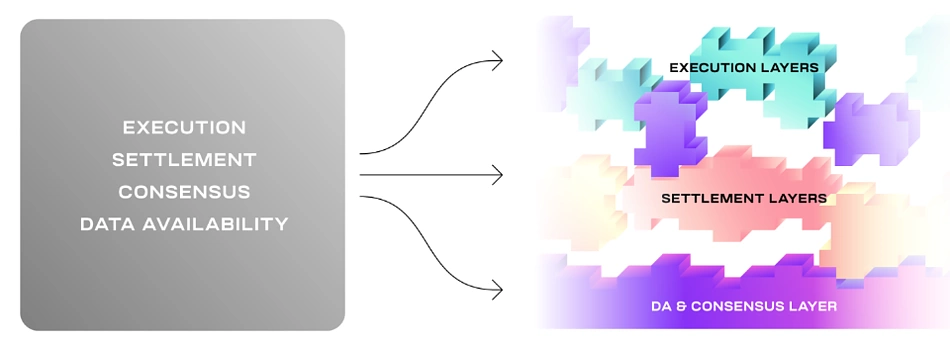

A blockchain can be broken down into four components:

-

Execution: transaction execution

-

Settlement: resolution/ fraud proofs/ bridge between other execution layers

-

Consensus: agreement on the order of transactions

-

Data Availability: providing accessible data for all network participants

In simpler terms, execution is where final points are tallied. New transactions get uploaded, and this new state is broadcasted. Settlement is where disputes take place. Any disagreements related to the validity of transactions are solved here. It is here that the bulk of variation between rollups becomes visible: optimistic rollups use fraud proofs, whereas ZKrollups use validity proofs. Consensus is the arrangement and agreement on the order of transactions. Data availability is the provision of data that allows anybody to verify transactions.

Celestia specializes in consensus and data availability, which walk hand in hand. Data availability requires consensus to arrange and order the data; otherwise, the history could not be determined.

Celestia: ‘A Dropbox For Rollups’

The best and most understandable description of Celestia comes from Twitter (X) user 0xngmi.

if youre confused about celestia you can think of it as dropbox but for chains

— 0xngmi (@0xngmi) November 14, 2023

Dropbox is a file hosting service offering cloud storage. Instead of storing data on a personal device, users leverage Dropbox. Having fewer stored files on a personal device improves its performance (execution), and Celestia’s value offering at a high level is perfectly encapsulated in this tweet.

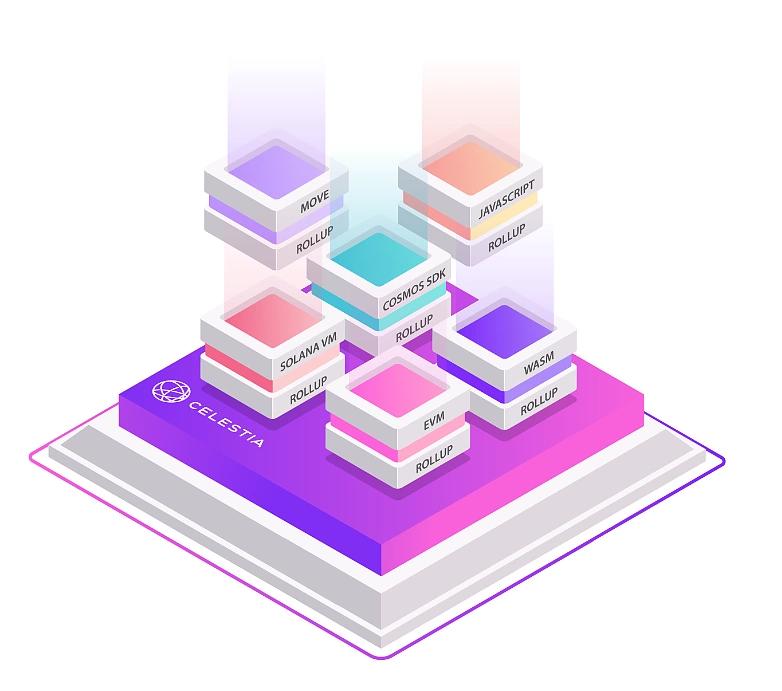

Celestia simply orders data and makes it available for rollups. Celestia handles and optimizes storage, allowing for higher performance. This modular building block grants Layer 2s the freedom and cost-effectiveness to explore new execution environments. This offering pushes for and enables more application-specific rollups.

The core message to developers deploying Layer 2s from Celestia is this: Let us handle all of your data availability and consensus requirements, and you focus on building the optimum execution environment for your application, whatever it may be.

Celestia Data Availability Sampling

Data availability means that any node in the network can verify that the information it receives is valid and builds on the classic notion of ‘don’t trust, verify.’ Data has to be stored to be verified, and Celestia's big breakthrough is data availability sampling (DAS).

Under the monolithic approach, each node downloads a full copy of the data, which it executes itself to ensure validity. This is execution heavy and quickly becomes expensive. Celestia’s DAS solution means that nodes only need to download a sample of each block as opposed to a full copy of the data. This technique allows light nodes to verify efficiently.

Light nodes are light because they do not download and process transaction data- avoiding downloading this data is why they prove effective scaling solutions. Celestia’s data availability sampling provides the strong data availability assurances these light nodes require. This new primitive enables Celestia to rapidly scale the number of participants (light nodes) and, therefore, data throughput.

Solving the Problems of Resource Pricing & State Growth

All decentralized blockchains have a finite capacity for resources. Nodes independently execute transactions to arrive at the virtual machine's current state. This has a resource cost. All nodes download transaction data to execute it and store it – it must be available upon request.

All of these actions require resources, and all resources come with a price tag. Blockchains naturally need to meter these resources. Resource metering is far more complicated than it would first appear, even more so when considering longer-term visions such as state growth.

Decentralization has been and always will be a core tenet of the Ethereum world computer vision. State growth refers to how quickly the blockchain is growing. Distributed ledgers store data, and as the network grows, so does the barrier to entry for operating a node. The centralization of node operators is not a theoretical problem and has played out over recent years. Naturally, as cost and difficulty barriers increase, more participants are forced out of the network. To keep a network decentralized it needs a diverse cohort of node operators.

Celestia’s solution only works because it is a data availability only chain. A general-purpose data layer makes resource metering more cost-effective and flexible compared to a monolithic chain. Data availability sampling verifies that the data is available without downloading it, and this is only possible because execution is not included. Sometimes described as a ‘Lazy Ledger,’ Celestia does no execution and is a blockchain where arbitrary data is dumped. It orders this data and makes it available.

Celestia introduces a Layer 1 responsible for data availability and ordering and has Layer 2s responsible for execution. Creating separate fee markets for data availability and execution allows markets to price each component independently, and separate markets mean more flexible and accurate pricing.

Modularity Thesis: The Start of the Modular Era

Monolithic design almost always precedes modular design. The monolithic build makes sense initially because it is less technically heavy. When the technology crosses a certain threshold and the basis of competition shifts from performance to cost and flexibility, the modularity era begins. Blockchains are entering this era.

Modularization is the commoditization of each module. It reduces cost, increases the rate of innovation, and bolsters flexibility. Free market agents compete to find optimal solutions, and builders can swap modules depending on their aims. Segmenting the monolithic blockchain into components will enable blockchains to scale well beyond their current limits. The rise of the specialist has been one of the defining trends throughout the 21st century, and why should blockchains be exempt?

When discussing complex frontier technologies, analogies are helpful. Imagine the monolithic blockchain as a start-up founder running the entire operation themselves. Product design, marketing, research, sales, and business development. The modular design is when the founder hires specialists for each role. Instead of doing everything all at once, outsourcing divides the workload and distributes it to the most efficient candidate.

Rollup Centric Future

Modularity began becoming popular under Ethereum’s rollup-centric roadmap. These smart contract rollups (general purpose) use Ethereum as their base layer for consensus and data availability, with execution and settlement occurring on Layer 2. Classic examples include Arbitrum and Optimism. These general-purpose chains execute and send batched transaction data back to the parent chain. If the modular thesis plays out on Ethereum, these general-purpose Layer 2s will eventually become the primary purchasers of Ethereum blockspace, replacing end users.

While most Layer 2s built on Ethereum are general purpose, Celestia’s rollup future diverges with an increasing focus on application-specific rollups. Referred to as Sovereign rollups, these app-specific chains use Celestia for consensus and data availability handling execution natively. The specialized nature of these chains is an extension of the Cosmos app-chain thesis. Cosmos certainly had the most profound vision but lacked finesse for execution. Celestia is the newest scaling technology, breathing life into back this thesis. However, Ethereum Layer 2s can still leverage Celestia for data availability while using Ethereum for settlement. Celestia has even released a modular data availability interface for the OP Stack.

Celestia’s Rollups-as-a-Service

Rollups-as-a-Service with Celestia underneath ✨

— Celestia (@CelestiaOrg) January 3, 2024

RaaS platforms make deploying a high-throughput blockchain as easy as deploying a smart contract.

Deploy today: https://t.co/nQfVjX7Xo5 pic.twitter.com/9thSRzM6DN

Celestia’s rollups-as-a-service allows for one-click deployment, and thanks to Celestia, blockchains can be created with minimal cost and time. In short, blockchains can bootstrap without validators, token distribution mechanisms, or consensus mechanisms. Celestia is putting the data availability in the plug-and-play stack.

TIA Tokenomics: Modular Money

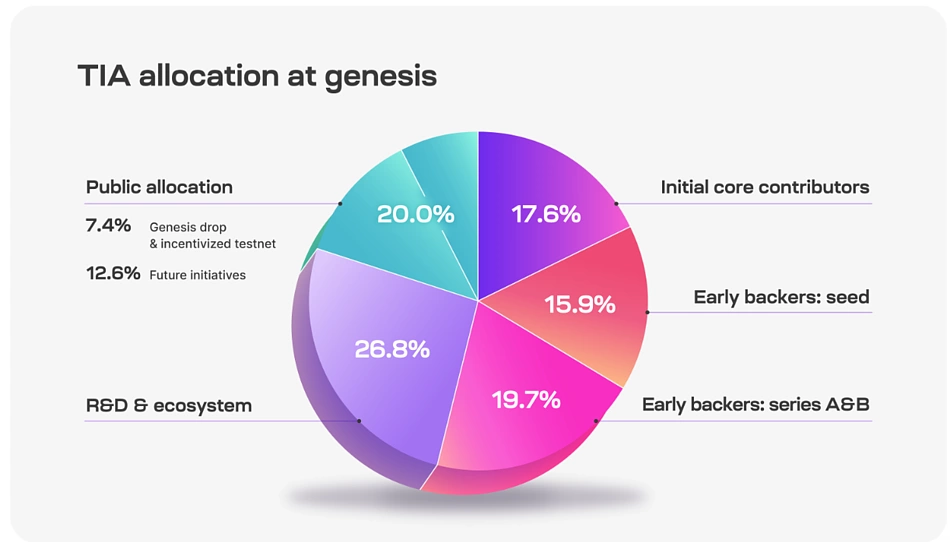

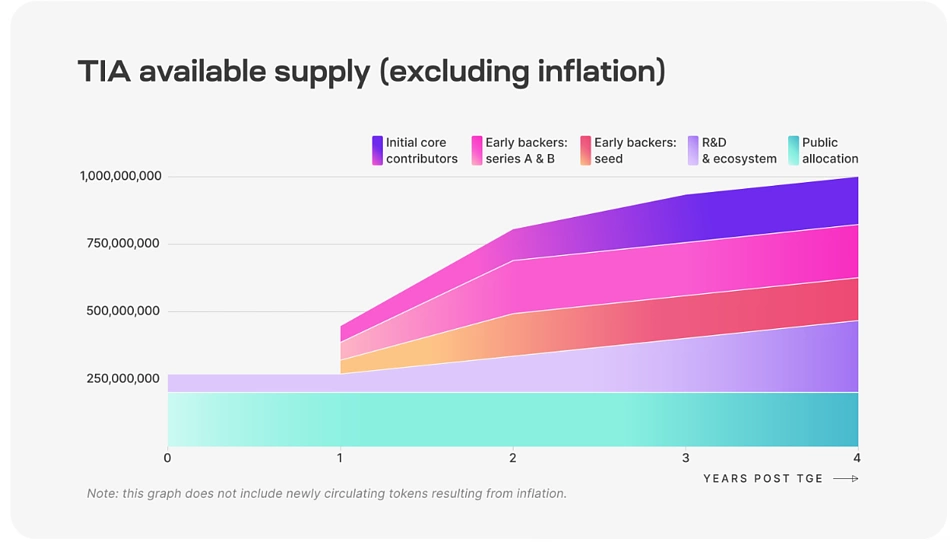

TIA. Modular money or killing fields for retail? Perhaps both? A large percentage of tokens have been reserved for insiders, and at the time of writing, the circulating supply is only 15% of the total supply. A small float always leads to an artificially high FDV (Fully Diluted Valuation), and this small circulating supply is a significant part of TIA’s incredible performance as of late.

The inflation rate is relatively high, starting at 8% annually, and decreases 10% year on year until it reaches the fixed long-term issuance rate of 1.5%. On average, Celestia delegators are currently earning 16% APY for staking their tokens, and it has been airdrop season for TIA holders. All TIA stakers were included in the recent Dymension snapshot, and given Celestia’s function as a data availability and consensus layer, it is likely that chains building using its services will airdrop tokens to TIA stakers.

TIA’s Price Performance

Summarizing TIA’s recent performance paints a bold picture. A small circulating supply, growing appetite to speculate on the modularity thesis, a 21-day staking unlock period, and a developing airdrop narrative. It is not surprising that TIA has displayed excellent relative strength under these conditions.

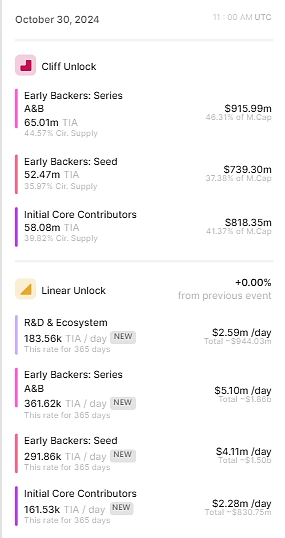

TIA Unlocks

But the elephant in the room is token unlocks. Over 50% of the total TIA supply is reserved for insiders, 53.2% to be precise. What happens when these VCs who bought TIA at a low–cost basis unlock their tokens? Will retail absorb this sell pressure?

On October 30th, 175.56 million TIA tokens will be unlocked. This equals 120.36% of the current circulating supply.

Over 100% of the market cap will be added overnight in cliff unlocks alongside a steady stream of linear unlocks. October 30th and the subsequent weeks will be the inflection point for TIA holders.

However, in bull markets, there is always a flip in the importance of flows. While emissions/ unlocks (bearish flows) have an outsized effect on price during bear markets due to a lack of overall market liquidity, new holders (bullish inflows) become king during the bull market. If the modularity thesis takes off and Celestia has killer rollups paying in TIA for data availability, the market can easily consume these unlocks. Additionally, TIA staking acts as a powerful token sink. The current airdrop meta combined with sizeable staking APY provides two powerful incentives for token locking, and locked tokens do not hit the order books.

Despite looming unlocks, TIA’s value proposition is highly impressive. All rollups pay for DA services in TIA, and it can be used as gas on chains meaning it is an excellent bootstrapping tool. Airdrops are another massive incentive for ownership, and until the launch of EigenLayer’s token, it is the only liquid vehicle for exposure to the modularity thesis. TIA is modular money.

Celestia’s Future: All Hail Modularity

Chris Burniske, a partner at Placeholder and a seasoned market operative with a better eye for value than most, is bullish on modularity. He has successfully surfed numerous waves, including Ethereum last cycle, flipped bullish on Solana near the bottom this cycle, and now has an interest in Celestia. Placeholder are early investors in Celestia, so this should be taken with a pinch of salt, but Burniske’s ability to spot future trends early is impressive.

$BTC and $ETH the OG crypto barbell.$SOL and $TIA the integrated + modular barbell.

— Chris Burniske (@cburniske) October 31, 2023

Blockchains enter their next era, and instead of relying on the one-man-bands (monolithic chains), specialists are being employed to focus on specific performance verticals. Celestia offers its services to order and make data available for rollups, and this ‘lazy’ approach devoid of execution allows it to optimize cost and performance.

Celestia delivers the scale and economic feasibility of ordering data for developers to build their own computational environments. In a sentence, Celestia is a foundational building block for creating customized execution environments.

Celestia is making it easier to deploy rollups and fundamentally represents the next iteration of the Cosmos app-chain thesis. The whole thesis is for Celestia’s DA layer to enable the creation of bespoke execution environments. It is a unique primitive unlocking a new wave of application-specific rollups, and Celestia will be the data availability layer underpinning this next generation.

Value runs downhill in this game, and narratives can quickly form around projects with the potential to eat the stack. Welcome to the era of modular money.

This article is for educational purposes only and should not be taken as financial advice. Always do your own research before investing in any protocol or token.

Kofi J has been active in DeFi since the 2020 summer explosion and has been rugged more times than he can remember. He hopes to make the decentralized economy a little bit more accessible through his prose. Follow the author on Twitter @k_pangolin

Or check it out in the app stores

Or check it out in the app stores