What Is GambleFi?

GambleFi is the collective term for decentralized applications providing crypto-based betting services. It refers to the movement of bringing online gambling on-chain to improve the user experience (transparency and fairness) and sidestepping many of the headwinds faced by the traditional model.

Key Takeaways

-

GambleFi denotes the convergence of gambling and blockchain technology. The distinctive feature being value accrual/ revenue share for token holders – the ability to own part of the house.

-

The starting point for this narrative was Rollbit’s migration to Ethereum earlier this year on June 28th.

-

Gambling as an industry boasts a predicted CAGR of 8.54% until 2027. There is still plenty of growth available, not to mention the potential of eating more traditional venue’s market share – competitive displacement – for these decentralized players.

This article is sponsored by Rollbit.

Gambling and crypto walk hand in hand and can loosely be considered adjacent industries on the basis that the agents operating within these zones possess a higher risk tolerance than most economic actors.

When discussing the GambleFi narrative, it must be clearly stated and understood that the projects contained within this category possess tokens with revenue-sharing properties. Users can ‘own’ a piece of the house for the first time. They can stand behind the curtain and share in the profits. This factor created and fueled the buzz surrounding these projects.

Any gambling entity has ingrained statistical advantages that ensure its profitability. Hence, the expression – the house always wins. But under the GambleFi flag, users can stand on the same side as the house, and holding any of these tokens at a high level is a bet that gamblers using the services will, on the whole, lose money.

Regulatory stance on this new outcrop of protocols remains incredibly murky, and with little oversight, crypto-based betting platforms can be fairly equivocated with offshore casinos. Narratives move fast, and regulation moves slow – a caveat to hold in mind when discussing projects under this broad umbrella.

Before we dive into GambleFi, please note that this article is only intended to provide an overview of the GambleFi narrative in cryptocurrency, featuring key protocols in the space, and should not be taken as promoting gambling.

How Does GambleFi Work?

GambleFi protocols in their simplest form are online venues leveraging blockchain technology, where users can make transparent wagers and own part of the house. Transparency and ownership/revenue share are the two distinguishing qualities of these protocols.

Transparency means provably fair results where users can verify the authenticity and statistical probability of their bets instead of relying on a centralized black box and an undisclosed algorithm. The results cannot be manipulated due to cryptographic hash functions. Ownership relates to the ability of an ordinary participant to own a token and earn a percentage of the platform earnings.

Picking apart the GambleFi narrative from more generic crypto casinos/gambling applications always comes down to tokenomics – the key feature being a stakeholder token that entitles holders to a portion of the generated revenue.

The Origins of GambleFi

Crypto and gambling have a long intertwined history. SwitchPoker introduced Bitcoin for the first time in August 2011, SatoshiDice was launched in 2012, Bitcasino and BitStarz came in 2014, industry leader Stake came along in 2017, RooBet launched in 2019, and all the way to the more modern era when Rollbit launched in 2020.

Although the GambleFi narrative took off in early 2023, crypto casinos have been widely popular since 2014. It was a breakthrough year with the Curacao Gambling Licensing Authority granting BitCasino a license. The year 2021 was another huge year for crypto-based gambling. Twitch streamers with massive audiences used crypto casinos on their streams, and YouTubers with younger viewerships aggressively promoted these platforms.

Since early 2014 crypto-based gambling fee generation and revenue have essentially been up-only on a long-term horizon. There have been drawdowns during bear markets, but the broader upward trend remains unbroken, mirroring the growth of the wider gambling industry.

Crypto Twitter’s Hand in GambleFi

Gainzy and Jingtao have played oversized roles in bringing GambleFi to its current crescendo with outrageous wagers and the dashing sprinkle of degeneracy adored by the community. Gainzy introduced a solid formula. Make huge bets, draw attention to the platform, and act as a user funnel.

https://t.co/vM5f9M9uxC pic.twitter.com/5axbnLAj26

— gainzy (@gainzy222) November 3, 2023

Jingtao is more enigmatic and has a quasi-unbelievable talent for sports betting. He arrived on Crypto Twitter, made a splash with a string of outrageous parlays, and then disappeared, only to resurface weeks later under a new handle. He provides an insight into how these entities treat what can be called ‘winners.’ Stake curtailed his wager limit – a problem faced by statistical oddities in the gambling industry that will likely never disappear whether in-person or on-chain.

Enormous wins and huge stakes from these actors fanned the flames of greed on both sides of the aisle. Certain people saw the bets and had ideas of replicating this success. Others realized that more and more people would now be wagering and sought to grab a piece of the ‘house.’

An influx of new users betting and an influx of investors chasing tokens hoping to earn from these new users. And just like that, the GambleFi narrative was born.

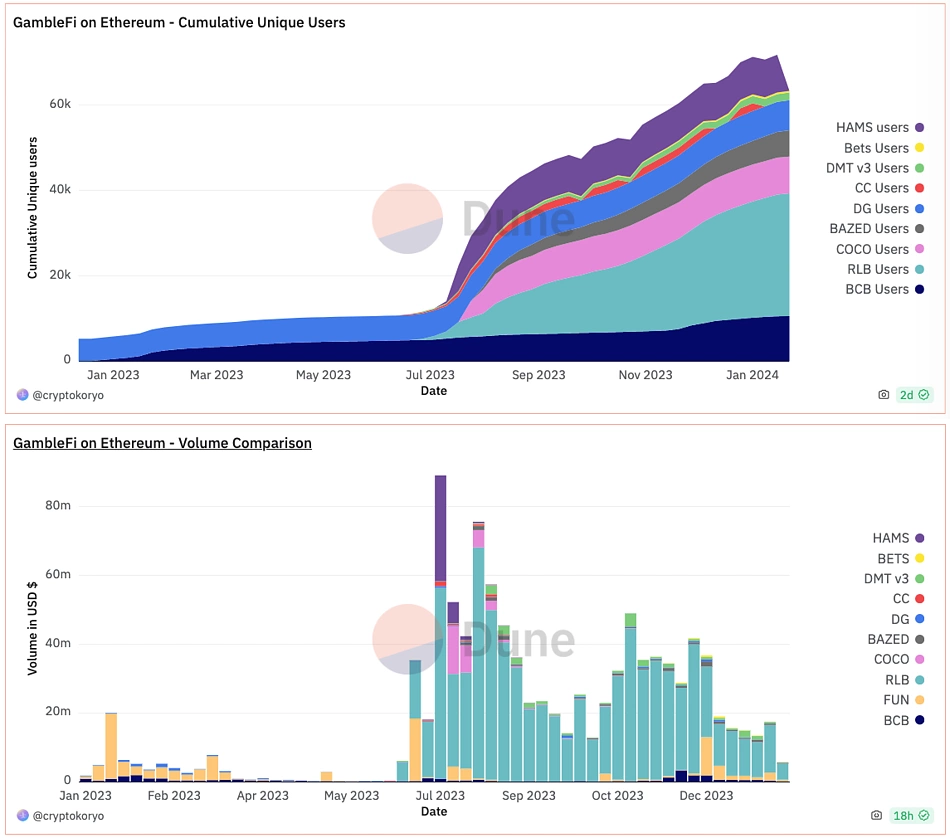

Source: https://dune.com/cryptokoryo/gamblefi

Why Is GambleFi Taking Off?

The above on-chain data shows the explosion of the narrative. Rollbit’s migration to the Ethereum blockchain occurred in late June and fired the starting pistol. Ethereum is where all the ‘old money’ lives in crypto, and all the capitalized degens reside.

Add bear market fatigue and boredom, which has a habit of pushing investors towards faster flips – remember memecoin mania – and into more speculative projects hoping to ride the wave fast and get out faster. HAMS perfectly exemplifies both behaviors – users resorted to betting on hamster racing, doing anything to alleviate the boredom.

Capitalized degens had a quick-fire method to speculate, with Rollbit offering classic casino games, sports betting, and futures trading. At this stage, there were users, but the real fireworks began in August when a tokenomics upgrade was announced.

Now, investors piled in, and the narrative had both sides. In the depth of the bear market, led by Rollbit, protocols emerged, boasting real users, growth, revenue, and speculative interest from investors.

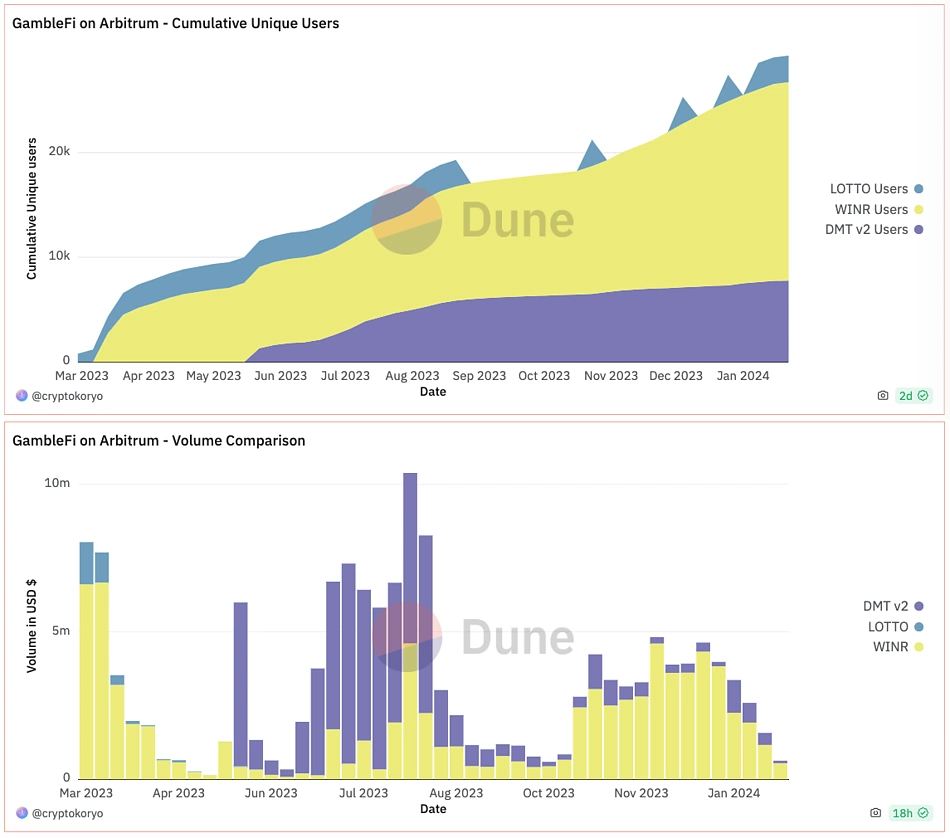

Outside of Rollbit's absolute dominance on Ethereum, Arbitrum has become the hotbed of innovation for the GambleFi narrative and entertainment projects. Given its low cost and speed, it presents an obvious choice and houses two of the narrative's most interesting players.

The following section dives into three projects in the GambleFi space. It must be noted that hundreds of protocols are operating in this zone, and the following projects have been selected for addressing specific market verticals, helping paint a panoptic picture of the narrative.

Rollbit: All-in-One Gambling Powerhouse

Rollbit has everything any traditional gambler or Web3 degenerate could want and more. Betting on the king has been a proven winning strategy in crypto, and Rollbit dominates the space without question. It faces competition from traditional platforms such as Stake and Roobet, which both offer conventional slot games and sports betting, and competition from more crypto-native betting platforms such as Shuffle.

Beyond traditional GambleFi offerings, Rollbit is also experimenting with new formats, such as its latest feature “Duel Arena.” Duel Arena is a 0% edge PVP game inspired by RuneScape, where users can wager cryptos, RLB, or NFTs. Rollbit takes no commission, and these luck-based duels will be verifiable on-chain via a hash and secret server seed that is released after the duel. It is a nostalgic winner-takes-all environment- perfect for the current class of crypto degens.

Outside of Duel Arena, the Rollbit platform provides three central services to the demand side: casino slot games, sports betting, and high-leverage futures.

Rollbit’s futures have become incredibly popular for several reasons. Firstly, low slippage makes them attractive. Second, the gamified interface. Third, the high leverage available for true degenerates. And finally, a nice and often underappreciated bonus of these futures contracts is that by nature of being futures, traders can avoid paying buy and sell taxes on tokens such as BANANA while still being able to speculate on the price movement. The perfect intersection of gambling and crypto?

Rollbit And The Power Of Token Price Go Up

There has never been any better marketing in crypto than token price going up. In early August Rollbit announced its Buyback and Burn program – arguably the crowning factor in its success.

RLB Revamped Tokenomics 🔥

— Lucky (@Lucky_Rollbit) August 8, 2023

~1 month ago we publicly stated that our primary goal is to make RLB the cornerstone of Rollbit.

Today we will deliver on that promise through launching the most impactful and highly anticipated feature to date: Buy & Burn

From today onwards, revenue… pic.twitter.com/tRzUWwBq1a

The concept is simple: take a percentage of the protocol revenue and use it to buy the RLB token. This process is executed entirely on-chain.

Following the announcement, the value of RLB skyrocketed more than 70% and has been in a progressive up-trend since. Why was this move genius? Not only does it distribute more value to token holders, but in bear markets, when liquidity is thin, adding one-sided buy pressure to a capital desert has an oversized effect on price. In the bull, revenue share wins out, but in the bear, buybacks are king.

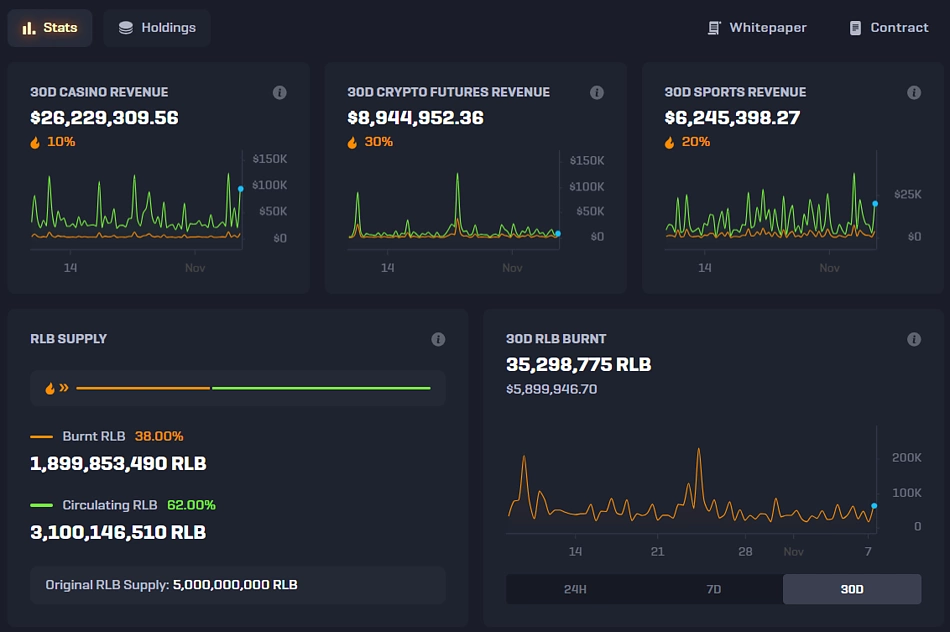

Rollbit’s revenue speaks for itself. The investment thesis is open and apparent: Rollbit generates revenue, it uses a portion of this for its Buyback and Burn program, the token price goes up, and the flywheel continues. The ability of Rollbit to deliver revenue and token appreciation for holders has undoubtedly pushed it to the center of the GambleFi narrative. Still, observing Rollbit's performance in a bull market will be more interesting.

As investors satiate risk-taking behavior in markets will it lead to a decrease in Rollbit’s casino revenue? It remains unknown, but thanks to its Futures offerings, which will likely overtake its casino earnings as speculative appetite rises, Rollbit appears well-positioned to enjoy continued success.

The central critique of the platform is that Rollbit does not operate entirely on-chain. It also does heavily promote gambling through influencers, but at the end of the day, gambling will always exist, and at least token holders see some of the upside.

WINR: GambleFi’s Native Liquidity Layer

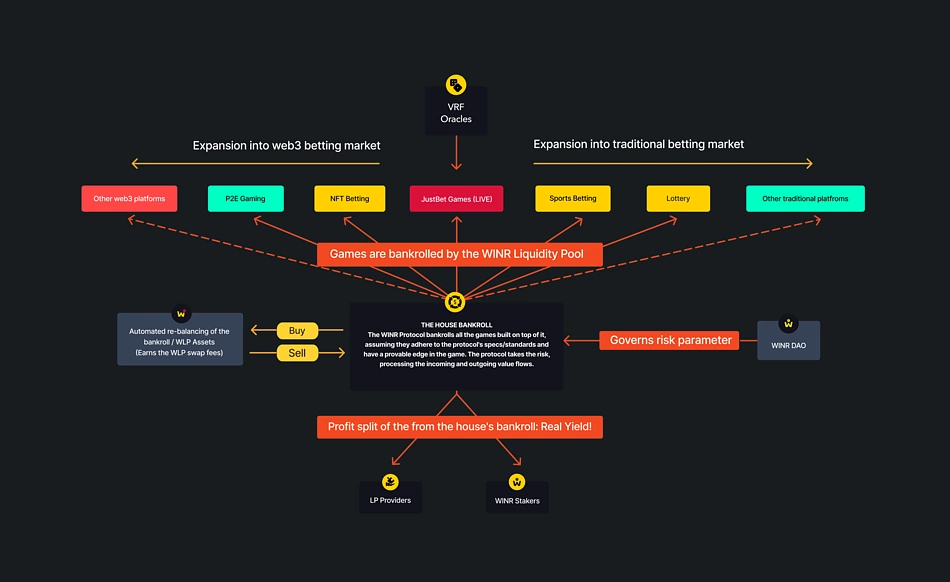

WINR operates in a different segment of the GambleFi narrative. Whereas Rollbit is an all-in-one casino with everything under one roof, WINR offers on-chain liquidity infrastructure for gambling protocols. Any on-chain game can leverage WINR as a counterparty, and it provides liquidity as well as incentives. Its current central competitor is Azuro.

Indeed, a more meta-play WINR provides unique advantages to all participants. Developers plug into a deep counterparty liquidity engine. Players enjoy fair games immediately settled on-chain and receive incentives in vWINR. And investors providing liquidity have the odds stacked in their favor. Everybody wins.

A key factor distinguishing WINR from many other operators in the GambleFi narrative is that it is fully decentralized and exists wholly on-chain. More excitingly, given WINR’s nature as a liquidity counterparty, its services provide the foundations for an essentially unlimited number of gambling protocols to be built on top of it.

Asset vaults have played a crucial role in DeFi, and all trades/ wagers require a counterparty. Users trading on DEXs use liquidity providers as counterparties. The rise of GMX and its GLP product brought attention to the potential of these community-owned counterparty vaults. Now, WINR delivers liquidity tooling relying on community liquidity that can scale horizontally as the GambleFi narrative grows.

WINR’s Mechanics And Implementations

The model is simple: WINR provides a liquidity stack. The liquidity token WLP is the counterparty for any game, and developers get plug-and-play access. $WLP token holders do not just own a piece of the house- they are the house.

WINR is currently developing a native blockchain built using Arbitrum Orbit. Dubbed the ‘Chain as a Backend’ approach, the WINR chain will replace traditional centralized backends and provide customized infrastructure to iGaming platforms – iGaming referring to any betting activities occurring online. All results will be verifiable on-chain, and eliminating intermediaries will reduce operational costs and improve efficiency.

At a high level, WINR wants to bring everything on-chain and deliver a new standard of transparency for players while creating a community-owned house. An obvious frontrunner when it comes to decentralization within GambleFi.

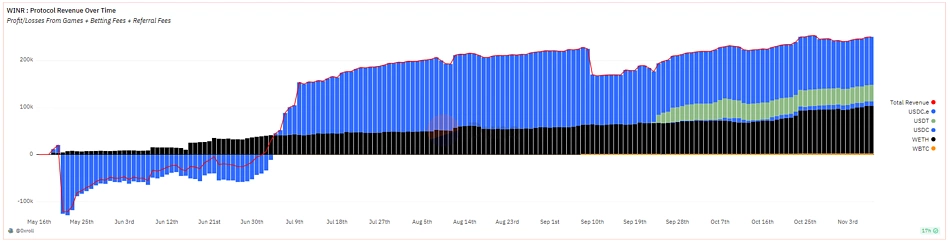

To date, WINR Labs has pushed two projects, and cumulatively, they have executed more than $260 million in volume. JustBet is a more typical decentralized casino providing provably fair games of chance, and DegenBets is precisely what it sounds like. A high-octane trading platform with leverage starting at 100X and scaling to 1000X.

WINR’s Future And Tokenomics

WINR employs a dual-token strategy with WLP – a basket consisting of WBTC, ETH, USDC, and USDT – acting as the counterparty and WINR and vWINR used as the liquidity incentives to drive volume through the WLP pool. Players of games using the WLP pool receive rewards in the latter (vWINR).

The WINR team has implemented a Bribe mechanism to ensure value accrual for WINR holders. The WLP pool pays a variable fee on each input. In short, every time a wager is made against the WLP pool, a percentage gets distributed to the WINR/vWINR staking pool (60%), a percentage goes to the buyback and burn of WINR (20%), and a portion goes to core developers (20%).

More than 75 million WINR tokens have been burnt – a little over 7.5% of the max supply. Additional revenue streams feed value accrual, such as unstaking fees and swap fees for the liquidity provider pool, which charges varying fees depending on the pool composition to encourage a healthy balance of assets.

In just six months from its launch, WINR has netted over $250,000 in profit for WLP, and total revenue has surpassed $1.1 million. The release of the WINR chain will add further demand and utility for WINR functioning as the network’s gas token. The new chain will feature Account Abstraction as the norm, upgrading the user experience and allowing liquidity to flow freely between any game that integrates WINR’s liquidity solution.

In short, the team has shipped aggressively, provided a fully decentralized infrastructure for online gaming, and created real yield on a deflationary asset.

Dream Machine: Blockchain-Based Game Console

Rollbit is the in-house gambling experience, WINR is the liquidity engine, and Sanko Dream Machine can be best construed as a gaming/ gambling layer. It straddles more verticals and has increasingly pivoted towards becoming a Layer 3 app-chain with the release of SankoTV – a decentralized alternative to Twitch where users can trade passes.

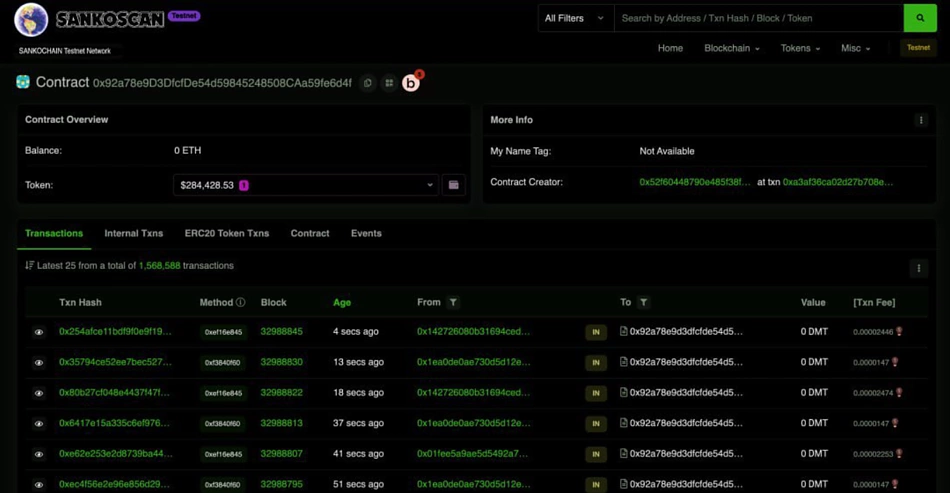

Beginning as a blockchain-based arcade built on Arbitrum centered around the native token DMT, Dream Machine was a pivotal player early in the GambleFi narrative. It boasts a variant of Tekken and other games like Poker, with prizes distributed in DMT to players at the end of each epoch (ten days).

Running with the analogy of an arcade, DMT functions as the tokens players need to play the games and acts as the medium of exchange across the entire economy. DMT can be staked to become a stakeholder in the ecosystem earning DMT rewards and became particularly popular due to the token having no VCs or early purchasers alongside the meme support of the Milady and Remillio swathes of Crypto Twitter.

A teaser of the SankoScanblock explorer was released in August this year. This is part of the Sanko GameCorp’s larger pivot towards becoming an entertainment chain – an Arbitrum Layer 3 app-chain seeking to become a virtual gaming console.

This token-based gaming ecosystem brings the best of decentralization to streamers, allowing for more direct value transfers from viewers, and has built out an increasingly impressive roster of games. The launch of the Layer 3 will further increase value capture for DMT holders and allow for the expansion of the SocialFi element.

Can GambleFi Improve the Gambling Experience?

GambleFi has enjoyed wild success as a narrative, but the question remains: can these protocols improve the experience for users versus traditional gambling outlets?

Overall, there are several notable improvements for both sides of the aisle. Gamblers enjoy greater transparency with everything housed on-chain and faster withdrawals, and investors have been allowed to take the role of the house and participate in the earnings resulting from their losses. The larger question is, do gamblers genuinely care about fairness and transparency? Unfortunately, there is no concrete answer to this question.

The success of platforms such as Stake and Roobet shows that the appetite for speculation remains high even without token ownership, and crypto payment rails are alluring to many would-be gamblers. The important meta point for the GambleFi narrative is that the house always wins, and gamblers always lose on aggregate. Decentralized gambling protocols are unique in the fact that investors can hold a piece of the house, and this remains by far the most significant upside of the deployment of on-chain gambling houses.

The Future of GambleFi

Online gambling revenue is projected to reach $95.05 billion in 2023 and grow with a CAGR of 8.54% until 2027, resulting in a market size of $131.90 billion. User penetration will ostensibly increase from 2.3% to 2.9% in the same period. In layman’s terms, there is still a colossal amount of room for the GambleFi narrative to grow.

Conversely, bolstered market sentiment may lead to a reduction in more traditional slot-style games as investors manage to satiate their risk appetite in markets. A study released in 2023, ‘How Do Financial Market Outcomes Affect Gambling?' compared racetrack wagering, the cornerstone of modern gambling, and showed that excess stock market returns negatively impacted gambling expenditures. This follows the classic wisdom that gambling becomes far more enticing during economic downturns. The logical inference is that leveraged trading services will become the primary breadwinners for GambleFi protocols headed into the bull market. And platforms providing these services are the ones to watch.

Negative headwinds include the crackdown from streaming platforms curtailing one of the most prominent user funnels. But, the most significant fear comes from a regulatory crackdown.

Europe leads the revenue race, trailed by North America and Asia Pacific. Growing crypto adoption worldwide will inevitably lead to more users gambling with crypto. Again, these market actors exist in close proximity on the risk tolerance scale. And a feasible argument can be made that on-chain sports betting could become a trojan horse for crypto.

Other long-tail growth impetuses come from the rising popularity of eSports betting and iGaming in Asia Pacific and China’s stringent regulation providing a perfect push factor toward online and perhaps on-chain gambling.

The reality is that as market sentiment flips increasingly bullish and risk-taking behavior gets rewarded, people’s risk tolerance skews, and they begin to engage in riskier and riskier behavior. This psychological aspect will be the largest growth driver for these speculative protocols, and again, projects with leveraged trading and futures functionalities will grow faster than their competitors.

Despite only mentioning three protocols, hundreds, if not thousands of contenders are in the GambleFi race. They are broadly distinguished into three categories: all-in-one in-house gambling bonanzas, liquidity layers/counterparty backends, and custom entertainment chains.

There is no denying the blunt reality that gambling is fun. The human brain has a penchant for randomness and variable reward ratio interactions. Sometimes an uncontrollable desire to engage in such behavior hence why governments take a stern approach to regulation. Still, GambleFi presents the first instance of ordinary folks being able to share in the house's profits, and for that alone, these decentralized alternatives deserve a nod of respect.

This article is for educational purposes only and is designed to provide an overview of the GambleFi narrative in crypto. It should not be taken as investment advice or promotion of gambling. Always do your own research before investing in any cryptocurrency protocol.

Kofi J has been active in DeFi since the 2020 summer explosion and has been rugged more times than he can remember. He hopes to make the decentralized economy a little bit more accessible through his prose. Follow the author on Twitter @k_pangolin

Or check it out in the app stores

Or check it out in the app stores