What Is Blast?

Blast is an upcoming EVM-equivalent optimistic rollup on Ethereum that offers native yield for both ETH and stablecoins (USDC, USDT, DAI) for depositors. At time of writing, Blast has a TVL of over $1 billion.

Key Takeaways

-

Blast is an EVM-equivalent Ethereum optimistic rollup with a native yield feature that aims to improve revenue and maintain value for network users.

-

The team behind Blast includes Pacman, the creator of Blur, a leading NFT marketplace on Ethereum.

-

Blast claims to offer ETH and stablecoins depositors a new “passive income” stream by putting assets deposited on its L2 platform to work.

-

Blast also plans to give 100% of gas fee revenue back to developers.

-

The prospective Blast airdrop to depositors has seen the project’s TVL rise to over $1 billion before launch.

Blast has garnered over $1 billion in stablecoins and ETH through its staking and native yield program. The Layer 2 network, whose testnet is scheduled for launch in January 2024 and mainnet in 2024, has seen an influx of resources. The recorded figure is expected to continue increasing as users continue to bridge their assets to Blast in anticipation of an airdrop.

The project was founded by Pacman, the individual credited with the creation of Blur, an NFT marketplace on the Ethereum network. It is also backed by VCs – Paradigm and Standard Crypto. Blast has become a hot topic amongst crypto natives due to its staking program and the native yield idea for users of the network.

So, what is Blast?

Understanding the Blast Layer 2 Optimistic Rollup

Pending initial launch, Blast claims to be an EVM-equivalent Layer 2 optimistic rollup network. As an optimistic rollup network, Blast will offer a higher transaction throughput and cheaper fees by batching multiple transactions (up to 10,000) and executing them at once, delivering a faster transaction speed and cheaper fee for each transaction.

As the name suggests, optimistic rollups assume that all transactions are valid until proven otherwise, and withdrawals require a 7 day challenge period before transactions are added to the main Ethereum blockchain.

As an EVM-equivalent network, Blast will allow developers to deploy their existing decentralized applications from EVM networks to the network without requiring changes to the original code. Compared to EVM-compatible networks, these Ethereum dApps will be run ‘as is’ when deployed on Blast. That is, the bytecode won’t be transcribed or transpiled into another language.

In addition to these features, Blast also claims to be the first and only Layer 2 network to offer native yield for ETH and stablecoins, along with a gas fee subsidy for dApps. Blast claims that these features will empower developers and regular users. According to available information, the cheaper fees on the network will enable traders on Blur – an NFT marketplace founded by the Blast team – to trade NFTs with cheaper fees and also offer yield for dormant assets on the marketplace; it also claims to be working on NFT perpetuals.

The native yield feature is Blast’s biggest attraction at this time, so let’s take a look at how it works.

How Does Blast Offer Native Yield on ETH and Stablecoins?

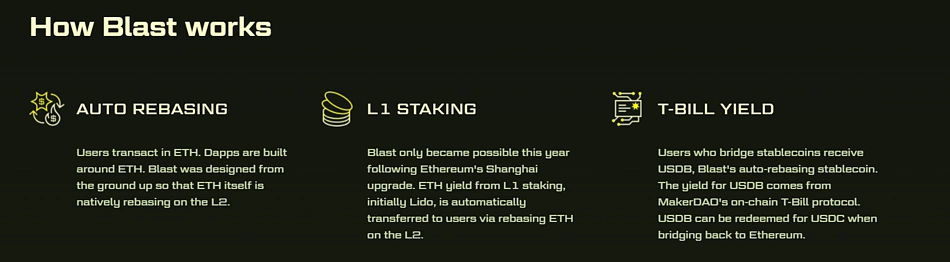

Blast offers 4% interest rates for ETH deposited on the network and 5% interest rate for stablecoins deposited on the network. Supported stablecoins include USDT, USDC, and DAI. It claims that the interest on these assets is compounding – that is, your balance on the network increases over time and interest applies to the current balance instead of the initial balance. The native yield feature is powered by rebasing tokens. The whole theory of native yield on the Blast is based on the Risk-free Interest Rate (RFR) yield structure.

For instance, with the 4% staking APR on Ethereum blockchain, ETH has an inflation rate of 4%. With no native yield on every other L1 and L2, every ETH that isn't staked runs a passive loss of 4% due to inflation. According to the project, the native yield feature salvages passive losses on assets deposited on the network. Blast developers claim that the native yield comes from ETH staking and RWA (Real-World Asset) protocols.

The 4% yield on Ethereum is sourced through the liquid staking on the Ethereum network. Sequel to the merge, the POS arm of the Ethereum network offers 4% APR on staked Ethereum. Cryptocurrency projects like Lido offer yield on staked Ethereum by utilizing this feature. Blast developers claim that no L2 network has explored the best ways to put this into use.

With Blast, the network developers are setting up a means to return value to users by staking their assets, where the Ethereum native yield protocol leverages Lido for staking user assets. In summary, when you bridge your Ethereum to Blast, the Ethereum deposited on the source chain contract is staked on Lido and you receive a rebasing canonical token on the Blast. This means your ETH held on Blast yields more ETH as long as it is held on the network.

The native yield algorithm for stablecoins follows a similar pattern. Blast developers claim that stablecoins bridged to the network are routed to T-bill protocols like MakerDAO. How this works: when any of the supported stablecoins are bridged to Blast, the protocol channels the stablecoins staked on the source chain to MakerDAO’s T-bill protocol, the user receives USDB on Blast. USDB is a native auto-compounding yield asset. This accumulates stablecoin profits over time at 5% APR. The user can redeem USDB for USDC when they bridge from Blast to Ethereum or any other supported network.

Blast developers claim that the working structure of the native yield system will be vested upon the community when the DAO goes live. The community will be able to select the ETH staking and RWA protocols in the future. That is, the community can vote to use third-party or Blast-native yield providers other than Lido and MakerDAO.

The BLAST Token Airdrop

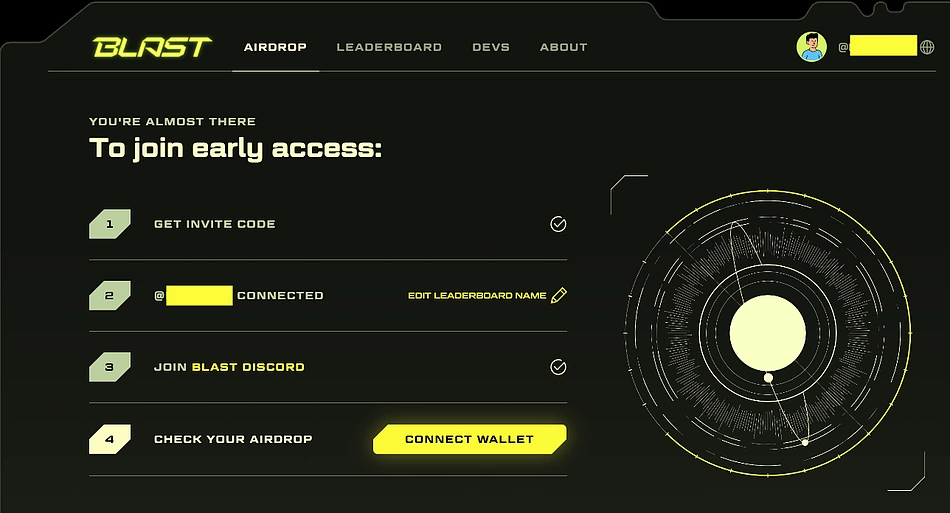

Blast is currently running an airdrop program, it is not sure yet if this is for the BLAST token, however, the airdrop program is based on usage and referrals. The airdrop program is currently gated; therefore, to participate, users must obtain a referral code from their peers or influences on social networks.

With the invite code, a user can sign up on the airdrop page and claim their sign-up reward. Registered airdrop participants can earn more rewards by bridging assets to the platform or inviting other users. Airdrop points are awarded relative to the value of assets bridged and the number of users invited.

Note that only the bridge to Blast is enabled at this time; assets bridged to the platform cannot be withdrawn until the Mainnet goes live, which is scheduled for February-March 2024. Airdrop participants can redeem their airdrop points from May 2024.

The deposited assets as part of the early access program are already earning the specified yield according to the project; this is in addition to the Blast points earned. The early access program is expected to last until Q1 2024. The leaderboard on the project’s website allows participants to view their progression and the top referrers.

Early Access and Community Concerns

Blast has taken off; the project has gained significant fame and has amassed a TVL of over $1 billion. However, the cryptocurrency community has multiple questions to ask regarding how the project works and how valid its promises are. As stated earlier, assets bridged to the platform are locked until the mainnet launches. Asset owners can only withdraw them when this happens, but the bigger question is regarding the custody of the assets.

Based on available information, the holding contract for the deposited asset is protected by a multi-sig of 5 participants. For any withdrawal request to be honored, at least 3 out of these participants must approve. First, these five participants are unknown at this time – the project founder still operates under a Twitter (X) pseudonym. It is also not clear what the criteria for the signature approval is.

Secondly, the rebase structure and whole native yield arrangement have also raised questions; comments on this post regarding the rebase token design for the Blast as being ideal for ‘strengthening ETH as money on L2s’ show contrary ideas on the feasibility and efficiency of the rebasing token design. While Blast developers and the project partners have shown strong support for the project and everything it promises, user reactions show a huge divide between interested communities, including regular users and developers.

While the questions on security and feasibility continue, users have continued to show unwavering interest in the project. Admittedly, the airdrop program is a huge incentive, as the sign-up counter shows more assets being bridged to the platform and more users joining.

The third concern is the proliferation of L2 networks with little to no difference in abilities. When Blast launches, it joins a long list of optimistic and zero-knowledge Layer 2 rollup networks with the goal of scaling transactions on the Ethereum blockchain. While existing networks have shown their ability to lower transaction fees and time, questions arise over the co-existence of tens of similar networks and the effect of the liquidity fragmentation on the general cryptocurrency outlook.

Blast vs. Other L2s

Blast claims to be EVM-equivalent, placing it alongside other L2s such as Optimism and Linea.

A distinct feature of the Blast is the native yield feature. When launched, Blast will be the first blockchain network to return passive income on the selected assets to holders without the need to commit them to a staking portal. The native yield feature works on paper, and will come into full practice when the mainnet launches; regardless, it is the first project to attempt this. If the feature works for ETH and the selected stablecoins, we could see a similar program for other crypto assets on the platform.

Also, according to available information, Blast will introduce other features like gas subsidies for developers and NFT perpetuals. The Blast development team has shown a significant focus on NFTs, likely due to its association with Blur. Relative to other L-2 networks, Blast’s focus on NFTs could see the network develop interesting features for NFTs, which could drive even more involvement from the NFT community and the network could dominate other L2s in terms of NFT activity.

Final Thoughts

The controversy surrounding Blast’s crypto staking program is expected. First, the relevance of the staking program to the platform’s technology and also the setup for the staking program. From available data, the staking program goes against the theories of decentralized staking with its multi-sig control of staked assets. And also the general management of the staked assets. The value of the airdrop points received by the stakers in comparison with the amount staked and the risk involved also raises a serious question. However, this has brought the project some publicity and has overshadowed the technology it plans to deliver.

Blast’s creator hints at a use case for the Blast Layer 2 network for NFT traders on the Blur marketplace. First is the plan to reduce gas fees for traders on Blur via Blast, and also the idea of yield for assets on the Blur marketplace. L2 networks have proven effective in providing higher throughput and cheaper transactions; however, it will also be interesting to see how the platform creates more financial value for NFT traders and other users through the native yield idea.

That being said, it is important to understand the risks and rewards involved in the staking program for investors who wish to commit their assets to the platform. As this article only discusses Blast on technological grounds, readers are also advised to apply caution and to do their own research when interacting with any crypto project.

Joel is deeply interested in the technologies behind cryptocurrencies and blockchain networks. In his over 7 years of involvement in the space, he helps startups build a stronger internet presence through written content. Follow the author on Twitter @agboifesinachi

Or check it out in the app stores

Or check it out in the app stores